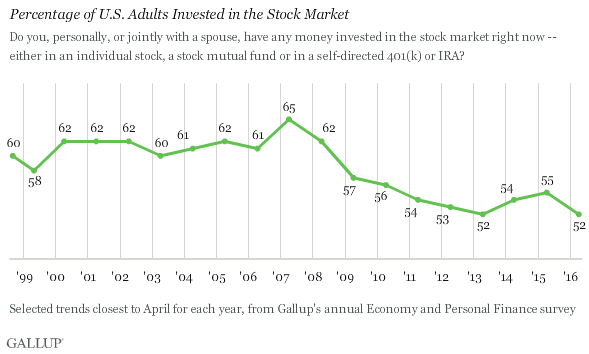

I spotted this chart this morning – it looks at the percentage of Americans with direct investment in equities.

There are a few things about this chart that caught my eye. The first was the obvious decline, Gallup attribute this to a shrinking number of middle class American being involved in the markets. This may be a generational issue or it may be a reflection of the effective collapse of the middle class in the US as inequality across all spectrum’s takes hold. The other data point I noticed was the blip in 2007 just before the GFC. This shouldn’t be surprising since ownership of any asset class moves higher at the tail of a boom. This is a natural feature of the boom bust cycle. In these cycles wealth transference seems to occur at the top of a move. There is similar data for Australia from the Australian Share Ownership Survey which was released last year.

Locally the downward trajectory seems to be more pronounced with no accompanying blip just before the GFC. My guess as to why there is a difference in the two curves is because of the impact of local factors. Australians love to buy real estate with the bulk of the nations wealth tied up either in the family home or a collection of investment properties. As someone who has been involved in markets on a day to day basis for over three decades it has been interesting to watch the change in the investing landscape. There were days when I was a broker that I had to take the phone off the hook simply to get some peace – looking at these figures my guess is that this is not happening these days. However, it does mean that there is a lot of slack in the system for when investors do return to the market.