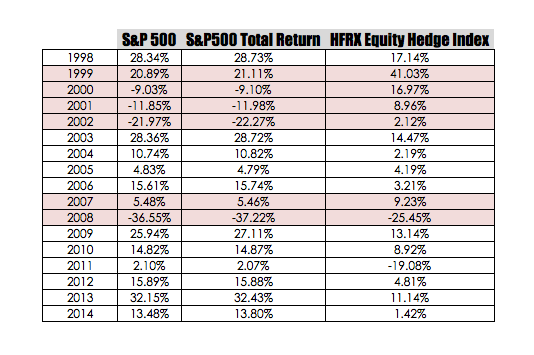

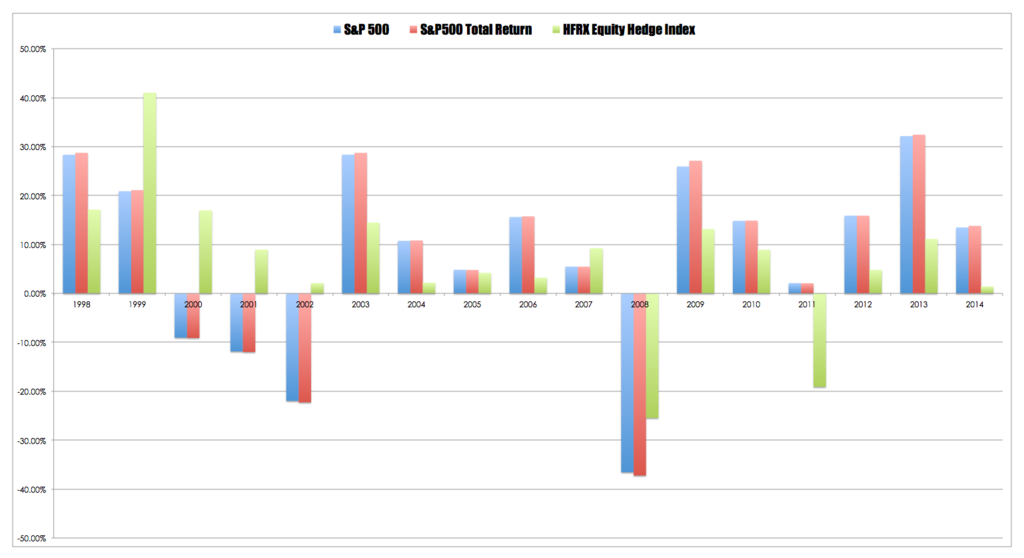

The good folks at Hedge Fund Research Inc produce a small cornucopia of data on the performance of hedge funds across a variety of categories. It is not the most riveting read but then pages of data metrics are not really supposed to be. However, the wealth of data does allow you to extract various pieces and compare them across asset classes and to some degree strategy. I pulled out the data for equity based hedge finds and compared it to the S&P500 Total Return data – the results of which are shown below.

There are a few things that are interesting about this data.

1. The index wins most of the time – this is true of all managed investments. Managers bring very little skill to the management process.

2. The starting year of the comparison matters. Start the comparison from 2000 and hedge funds look even worse.

3. Hedge funds start of with a bang – judging from the performance in following years it is interesting to note the degradation in performance in subsequent years.

4. I might suggest that the early years for hedge funds were a fluke.

5. I have not generated a hypothetical equity curve based upon these returns but my guess from looking at the results is that the initial strong period for hedge funds gives them an early lead which is then pegged back as their performance degrades.